9 Best Payroll Services For Small Business Of 2024

- 2021-07-27

- 00:03

For example, it allows you to input tax credit information into the payroll system and then prepares forms 8974 and 941 for you to claim those credits. Gusto is made for startups and growing small businesses with a mix of employee- and contractor-based workforces. It is best for businesses that expect to eventually expand across state lines or even globally using a workforce with a mix of contractors and employees.

Navigating the intricacies of payroll management can often feel daunting. That’s because the steps required to pay employees each pay period accurately require time and resources you may not have. Fortunately, the right payroll management system can help streamline the process. But what exactly does an effective payroll system look like, why is it important, and which specific tasks can it help you complete? To determine the best payroll services for small businesses, Forbes Advisor researched the industry and analyzed 23 different companies and their plans. We then scored these contenders across 34 metrics in five categories weighted to favor features that small business owners find valuable in a payroll provider.

Support

Completing payroll involves many key steps, a few of which include accurately calculating employee wages, making independent contractor vs employee the appropriate deductions, processing payroll taxes, and accurate recordkeeping. A payroll management solution systematizes these tasks, helping businesses manage payroll operations and fulfill their obligations to pay employees each pay period. Depending on the business and its needs, payroll management systems can look like a manual solution, in-house software, or outsourcing — each explained in more detail later in this article.

ADP is the largest and one of the most trusted payroll providers in the world. RUN is its small business solution and a good place to start if you’re a small business expecting to grow into a large enterprise. ADP RUN is a simple payroll and benefits administration platform with room to grow into enterprise plans with the main ADP platform. It boasts a score of 4.5 from 1,900 reviews on G2 and a score of 4.7 from over 3,800 reviews on Capterra.

Manage time tracking

Payroll management is an important part of any business because it helps improve employee engagement and regulatory compliance. Without an efficient, accurate means of paying employees, depositing and filing taxes, and maintaining records, employers could face wage claims and expensive penalties. Put simply, a payroll management system is the process by which employers pay wages to their employees. It’s also how they demonstrate their commitment to their workers, fulfill their obligations to government agencies and keep financial records in order.

The payroll software you use should integrate with QuickBooks or whichever accounting software you use to keep an accurate record of payroll history in the event of an audit. Payroll software should also integrate with benefits administration software for accurate deductions and with time tracking software. Rippling is best for small businesses that hire talent internationally and need an automated way to handle payroll runs, compliance and tax filings across the globe. It is also best for growing businesses that need automation tools to scale their payroll and compliance efforts as they grow.

View Employee Information

You simply choose a schedule—Gusto automatically suggests one for you—and confirm state tax details based on where employees are located. There are plan tiers with OnPay—you pay one base monthly rate and then a flat fee per person per month. The base rate is $40 per month, and then you pay $6 per person per month, so, for a company with 100 employees, OnPay would accounting for artists cost $640 per month. As you lose or gain employees, the price adjusts to reflect the new user number.

- ADP RUN is a simple payroll and benefits administration platform with room to grow into enterprise plans with the main ADP platform.

- 2 Paychex Promise will be offered free of charge to business owners for the first three months of service, and thereafter will be offered as a complete suite of services for a fixed, all-inclusive fee.

- You can add on benefits administration for an extra fee and let employees manage and enroll in benefits through the self-service portal, as well.

- The employee app offers a robust self-serve interface that is efficient and not overwhelming.

- So, from one place, you can manage not just payroll, but also benefits, employee absences, 401(k) contributions, insurance premiums and more.

We use product data, first-person testing, strategic methodologies and expert insights to inform all of our content so we can guide you in making the best decisions for your business journey. Uncover trends for better decision-making with interactive reports and insights. Our payroll system allows you to customize your data and access our library of 160 standard reports for answers. Always be plugged into the latest payroll information, employment law changes, and best practice information. This compliance tool can help keep you informed while you mitigate risk.

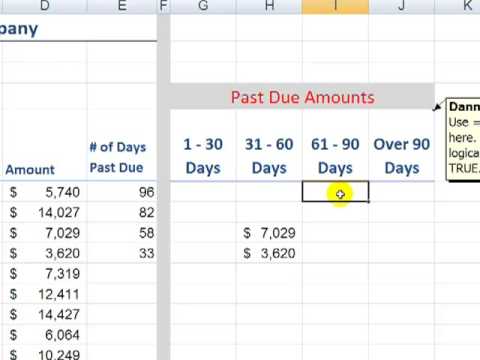

Here’s a breakdown of the categories we used to rank the providers that made the top of the list. To change pay rates or correct time worked, I only had to click on a cell to input the new data point. Filters along the top of the spreadsheet allowed me to easily discounted payback period capital budgeting calculator add or remove columns of information I needed, such as bonuses, holidays, paid time off, overtime premium and overtime hours. Once I’ve reviewed the pay run, I simply had to click “approve payroll” to run my payroll for that pay period. However, they say that the software does not offer enough customization options, nor does it offer detailed reporting to meet their needs.

Compared to manual data entry, online payroll software can save you considerable time. The features available in the package you choose will ultimately determine your total work effort. Save time and reduce costly errors when you connect and share data between our payroll software, Paychex Flex®, and dozens of other business applications. We can help you engage your workforce, increase efficiency, save time – and grow with you as your business does.