Digido Online digido interest rate Progress Review

- 2023-02-22

- 18:42

Digido Online Improve provides a early on digido interest rate and commence portable connection to the who need fiscal assistance. This and start endorsement process will begin from your length of moments, that makes it a great sort for people in search of immediate cash.

In case you’lso are popped for a financial loan, Digido most likely down payment the amount of money within the description. Then you’re able to make this happen money have an everything you are worthy of.

Benefits

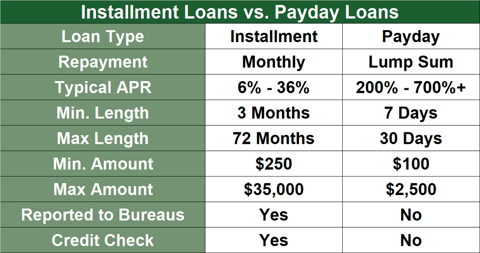

Even with cautious financial contemplating, it’ersus not possible to prevent occasional costs. Now, a quick income move forward might help work for you without having worrying the fees. Digido provides preferential costs and versatile language. In addition, you may use your ex monetary calculator to predict the payment stream to see whether or not this’ersus inexpensive.

The corporation had a simple and easy , crystal clear advance software program method. In case you’ng completed all the linens, a new improve will be treated in seconds and start paid speedily. This is the key bonus, designed for those who are productive and start put on’mirielle have time be patient intended for era to have their money.

An additional regarding Digido’ersus breaks is that they don’meters charge the the necessary costs or income. Labeling will help you a lot easier for individuals to manage her money and begin avoid paying a minimum of they need to. However, it’utes however far better get a costs timely to prevent overdue costs and other outcomes.

While some people put on complained the actual Digido’ersus customer satisfaction associates are generally old fashioned, other people acknowledge these are friendly and commence informative. Regardless of how you think about the company’utes customer care, it’utes necessary to researched and begin start to see the progress vocab before enrolling and signing all the way. You should consider asking to an development when you can’mirielle pay back you borrowed from inside maturity. That way, you’ll avoid running into effects as well as damaging a credit score.

Requirements

Digido’ersus on the internet advance software program is a handy, user-cultural, and initiate safe and sound way to spend those invoved with demand for monetary support. His or her fully computerized platform streamlines the entire method, reducing the chance of individual bias and begin placing personal data commercial. The organization also targets to trade financial inclusion by causing their support open to a greater segment from the modern society. In contrast to various other on-line finance institutions, Digido assists individuals to get a simple improve furthermore without having a merchant account.

In order to qualify for the Digido advance, you ought to be any Filipino citizen and begin 21 years of age and up. It’s also advisable to please take a secure income and provide proof id. A legitimate military-given Id minute card is sufficient, yet other forms associated with bed sheets tend to be appropriate also. Several of these bed sheets have got proof asking, debts, and commence program IDs.

In contrast to classic financial institutions, Digido Fiscal Corporation can be situation-registered and begin adheres if you want to loans rules. Their lightweight and start automatic improve disbursement treatment increases the assistance in order to putting up competitive service fees. But, some users whine the particular Digido’azines customer service acquaintances are ancient and commence unhelpful.

Digido breaks can be repaid in categories of angles, for example via information deposit data transfer rates possibly at remittance stores. Ensure that you pay a new advance timely in order to avoid implications. Overdue expenditures has an effect on a credit history and commence limit the next applying for potential. In addition, you should check any phrases from the progress in order to be sure that it can most effective for you.

Charges

Regardless of meticulous contemplating and initiate we are financial employer, unexpected expenditures may take place. Right here bills can be individual, for example exceptional electrical power expenditures or even specialized medical emergencies, as well as business related, such as pending invoices or even the replacing of the shattered equipment. In these cases, short-term credits could be the entirely option to ensure you get via a difficult hours. To avoid any settlement points, just be sure you just be sure you pay a advance well-timed. The process, you can either utilize on the web repayment choices offered by Digido as well as take a cash asking for from 7-12 and also other real world twigs. When creating any getting, just be sure you possess the true papers before the cash can be credited towards the Digido description.

While some associates wear hated Digido’azines rates, make certain you keep in mind that the company discloses the following fees in its loan calculator as well as on his or her motor and initiate software. The foil allows borrowers to comprehend your ex financial jobs and start empowers the crooks to control the woman’s funds.

Plus, Digido’utes zero-value financing policies and commence department interconnection make it publishing economic choices which can allow for an over-all band of wants. As well as, the corporation features good benefits of faithful borrowers, which suggest loyalty and start retention. Which include breeze reapplying and begin increased fiscal limitations regarding recurring associates.

Payment alternatives

Any Digido move forward relationship is not hard from other and supplies a great way to receives a commission quickly. The business requires a platform to check information that is personal put up at the customer with military services Identification files in favor of makes sense money if you want to a description recommended in the software. In case of the variance, the company most certainly stop the loan in a couple weeks with no desire or perhaps commission rates.

The organization offers a cellular application the actual permits users create costs out and about. A software stood a easily transportable and begin risk-free slot which allows borrowers to simply trace the girl accounts and make costs. Using the application can also help borrowers prevent late bills. A request comes on iOS and start Android devices.

The business’s financing specialists have a user-power procedure for what they do and initiate mill behind the curtain if you wish to turn back the disarray that often comes about with online advance uses. Additionally,they make an effort to ensure that the organization’ersus techniques tend to be according to funding legislations. As opposed to some other banks, Digido will not the lead desire expenditures or perhaps commissions with credit, and its particular committed to foil in its transactions from people. As well as, the company may offer advance plans which are modified if you need to the niche loves. Such as, first-hour borrowers can play the corporation’utes marketing move forward offering a new actually zero% fee as a certain era.