Publication 946 2023, How To Depreciate Property Internal Revenue Service

- 2020-11-20

- 22:41

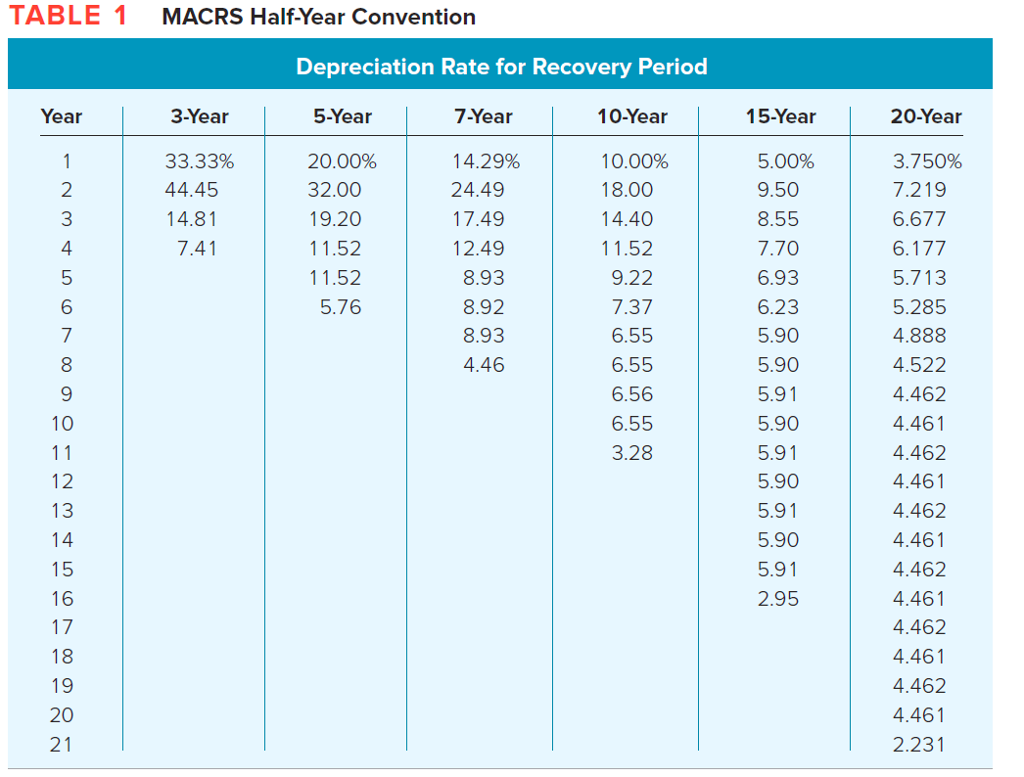

The most common declining balance percentages are 150% (150% declining balance) and 200% (double declining balance). Because most accounting textbooks use double declining balance as a depreciation method, we’ll use that for our sample asset. Duforcelf, a calendar year corporation, maintains a GAA for 1,000 calculators that cost a total of $60,000 and were placed in service in 2020. Assume this GAA is depreciated under the 200% declining balance method, has a recovery period of 5 years, and uses a half-year convention.

Advantages of the Declining Balance Method

- Assume the same facts as in Example 1, except that you maintain adequate records during the first week of every month showing that 75% of your use of the automobile is for business.

- Larry’s deductible rent for the item of listed property for 2023 is $800.

- The midpoint of each quarter is either the first day or the midpoint of a month.

- Generally, if you can depreciate intangible property, you usually use the straight line method of depreciation.

- Financial accounting applications of declining balance are often linked to income tax regulations, which allow the taxpayer to compute the annual rate by applying a percentage multiplier to the straight-line rate.

The property cost $39,000 and you elected a $24,000 section 179 deduction. You also made an election under section 168(k)(7) not to deduct the special depreciation allowance for 7-year property placed in service last year. Because you did not place any property in service in the last 3 months of your tax year, you used the half-year convention. You figured your deduction using the percentages in Table A-1 for 7-year property.

Credits & Deductions

If property you included in a GAA is later used in a personal activity, see Terminating GAA Treatment, later. To make it easier to figure MACRS depreciation, you can group separate properties into one or more general asset accounts (GAAs). You can then depreciate all the properties in each account as a single item of property. If you have a short tax year after the tax year in which you began depreciating property, you must change the way you figure depreciation for that property.

Why Is Double Declining Depreciation an Accelerated Method?

You reduce the adjusted basis ($288) by the depreciation claimed in the fourth year ($115) to get the reduced adjusted basis of $173. You multiply the reduced adjusted basis ($173) by the result (66.67%). Figure your depreciation deduction for the year you place the property in service by multiplying the depreciation for a full year by the percentage listed below for the quarter you place the property in service.

Calculating Declining Balance depreciation

The fourth quarter begins on the first day of the tenth month of the tax year. You figure depreciation for all other years (before the year you switch to the straight line method) as follows. If you elect not to apply the uniform capitalization rules to any plant produced in your farming business, you must use ADS. You must use ADS for all property you place in service in any year the election is in effect.

Reducing balance method causes reported profits of a company to decline by a higher depreciation charge in the early years of an assets life. Reducing Balance Method is appropriate where an asset has a higher utility in the earlier years of its life. Computer equipment for instance has better functionality in its early years. Computer equipment also becomes obsolete in a span of few years due to technological developments. Using reducing balance method to depreciate computer equipment would ensure that higher depreciation is charged in the earlier years of its operation.

If the MACRS property you acquired in the exchange or involuntary conversion is qualified property, discussed earlier in chapter 3 under What Is Qualified Property, you can claim a special depreciation allowance on the carryover basis. If you made this election, continue to use the same method and recovery period for that property. An improvement made to listed property that must be capitalized is treated as a new item of depreciable property.

During the fourth week of each month, you delivered all business orders taken during the previous month. The business use of your automobile, as supported by adequate records, is 70% of its total use during that fourth week. You can account for uses that can be considered part of a single use, such as a round trip or uninterrupted business use, by a single record.

For the year of the adjustment and the remaining recovery period, you must figure the depreciation yourself using the property’s adjusted basis at the end of the year. This method lets you deduct the same amount of depreciation each year over 150 declining balance depreciation the useful life of the property. To figure your deduction, first determine the adjusted basis, salvage value, and estimated useful life of your property. The balance is the total depreciation you can take over the useful life of the property.